Hits: 16

Stocks rallied on Wednesday after the Federal Reserve hiked rates by 75 basis points — its largest increase since 1994 — and signaled it could raise rates by a similar magnitude in July, giving investors confidence the central bank was committed to tamping down inflation.

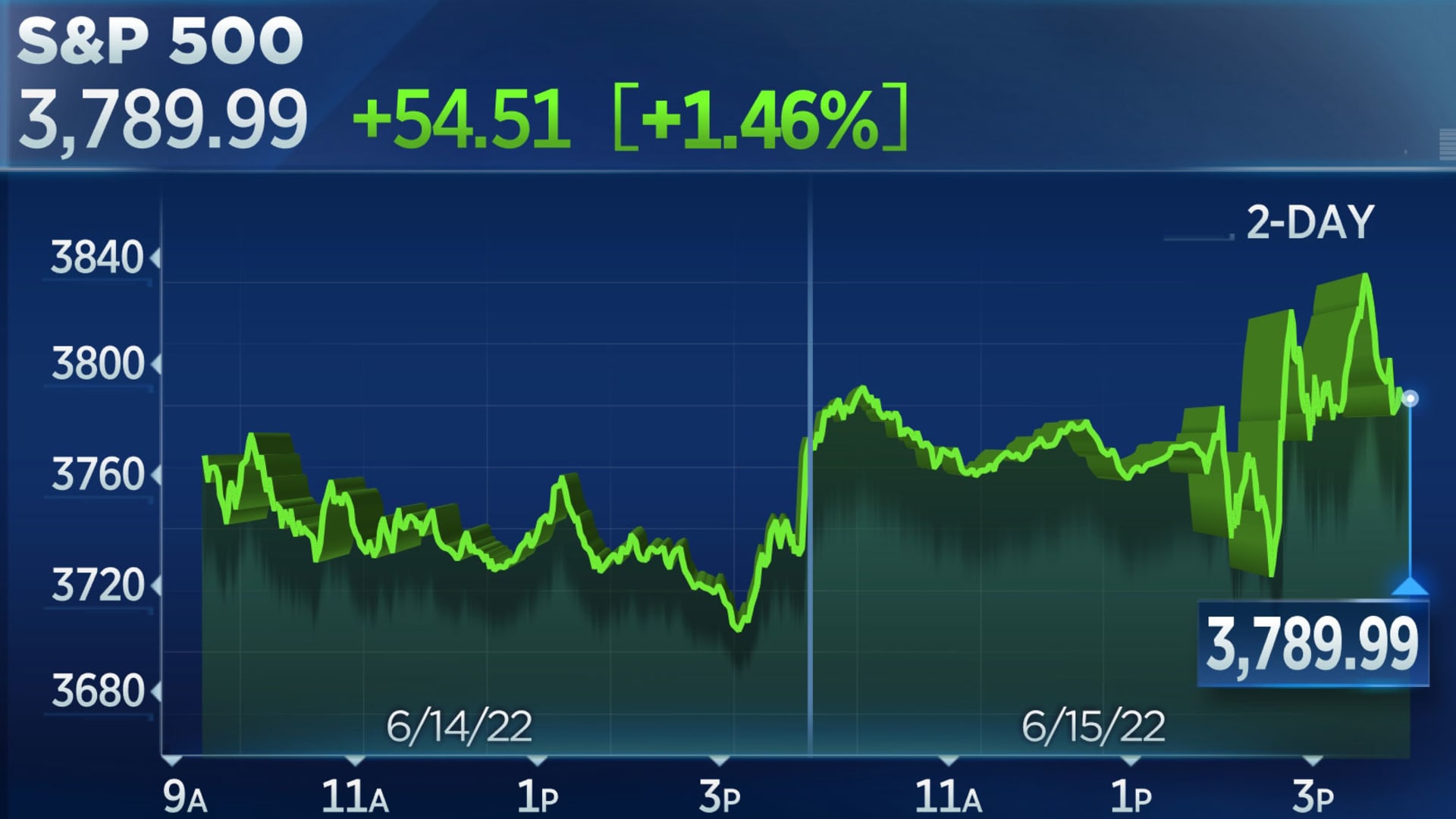

The Dow Jones Industrial Average snapped a five-day losing streak, jumping 303.70 points, or 1%, to close at 30,668.53. The S&P 500 rose 1.46% to 3,789.99 while, the Nasdaq Composite gained 2.5% to end the day at 11,099.15.

Stocks were volatile after the rate hike decision but jumped to session highs as Fed Chairman Jerome Powell said during his afternoon press conference that, “either a 50 basis point or a 75 basis point increase seems most likely at our next meeting.”

The market had anticipated a 75 basis point rate hike Wednesday, but it was Powell’s willingness to do another hike of that size that surprised markets.

“The more aggressive stance can still be consistent with a softish landing for the economy, but the path is getting narrower,” wrote Barry Gilbert, asset allocation strategist for LPL Financial. “We still think the Fed may be able to back off from its new forecast of a 3.4% benchmark rate at the end of the year, but for now, the priority is showing resolve.”

Boeing and other shares closely linked to economic growth jumped higher on the hope that rates could rise without tipping the economy into a recession. Boeing surged 9.5%. Regional banks and financials also gained.

Tech shares, which have been beaten up as the S&P 500 slipped into bear market territory this month, led the market’s bounce with Amazon and Tesla each jumping more than 5% on Wednesday. Netflix also gained 7.5%.

At the conclusion of its two-day policy meeting, the Federal Open Market Committee said in a statement it was “strongly committed to returning inflation to its 2 percent objective.”

“Today’s announcement confirms the Fed’s commitment to fight the inflation battle more aggressively despite the potential aftermath from raising rates at such a rapid pace,” said Allianz Investment Management’s Charlie Ripley. “Overall, Fed policy rates have been out of sync with the inflation story for some time and the aggressive hikes from the Fed should appease markets for the time being.”

The Fed’s benchmark rate is now slated to end the year at 3.4%, based on the midpoint of the target range of individual members’ expectations.

Battered travel names staged a comeback with cruise stocks Carnival and Norwegian Cruise Line rising about 3.4% and 5.5%, respectively. Shares of airline stocks including Delta and United also rose about 2% each.

All major sectors aside from energy, which slipped 2%, ended the day higher. Consumer discretionary saw the biggest gain, jumping 3%.

Along with the rate hike, Fed officials slashed their GDP outlook for 2022 to a 1.7% gain from the 2.8% projection back in March. Inflation projections also rose to 5.2% this year from 4.3%, but the committee expects that to tick lower in 2023.

Be the first to comment