Hits: 53

Kenneth Fisher, chief executive officer of Fisher Investments, speaks at the Forbes Global CEO Conference in Sydney, Australia, on Tuesday, Sept. 28, 2010.

Gillianne Tedder | Bloomberg | Getty Images

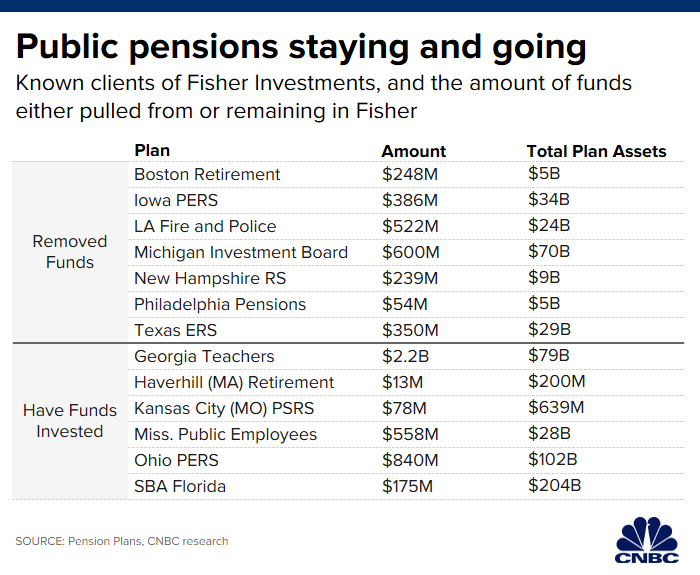

The Employees Retirement System of Texas announced on Friday that it would end its relationship with Fisher Investments, yanking $350 million from the asset manager.

“Texas ERS has completed its due diligence,” said Mary Jane Wardlow, a spokeswoman for the pension system.

“With respect to our fiduciary duty, we are defunding Fisher Investments, which had served as an external manager in the international equities portfolio with $350 million [as of Sept. 30] under management,” she wrote in an email to CNBC.

The funds will be redistributed within the equities pool of the ERS trust, she said.

In all, the pension has about $29 billion in assets.

In just over two weeks, Camas, Washington-based Fisher has lost more than $3 billion in assets as nine institutional clients — seven of which were government pensions — severed ties. The divestitures arrive on the heels of lewd comments Ken Fisher made at a conference on Oct. 8.

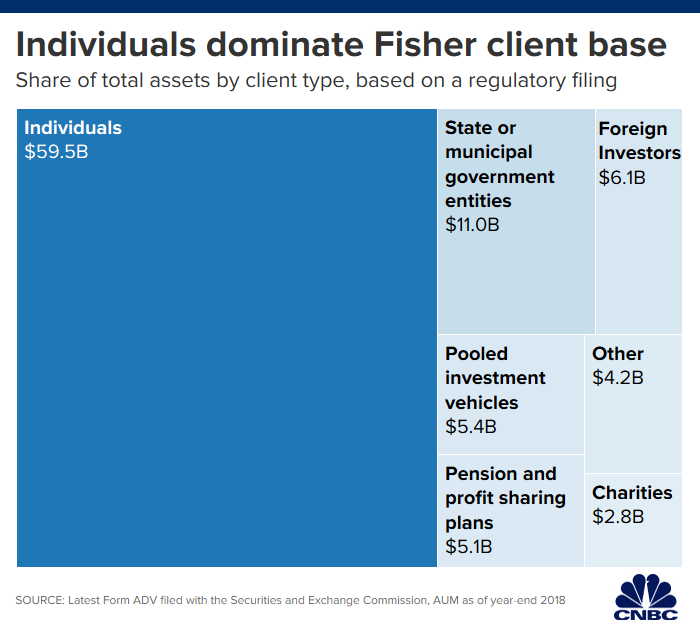

Fisher had $94 billion in assets under management as of Dec. 31, 2018, according to their SEC filing.

That figure reached $112 billion as of Sept. 30, 2019, according to the firm.

Major clients have parted ways with Fisher, 68, in the last two days.

Goldman Sachs, the giant investment bank, confirmed Fisher would no longer be an underlying manager for the Goldman Sachs Multi-Manager Global Equity Fund in an Oct. 25 filing with the Securities and Exchange Commission. It pulled $234 million from the firm.

On Thursday, the Los Angeles fire and police pension plan also voted to fire Fisher, which managed $522 million.

Conference controversy

CNBC obtained an audio recording of Fisher’s comments at the Tiburon CEO Summit, as well as audio of him speaking at a previous conference.

Clips from both were featured on CNBC’s “Power Lunch.” Combined, they show that the money manager made flippant remarks about sex.

In the audio obtained by CNBC, Fisher said at the Tiburon conference, “Money, sex, those are the two most private things for most people,” so when trying to win new clients you need to be careful.

He said, “It’s like going up to a girl in a bar … [inaudible] … going up to a woman in a bar and saying, hey, I want to talk about what’s in your pants.”

Further, when Fisher was a speaker at the Evidence-Based Investing conference in 2018 he compared marketing mutual funds to propositioning a woman for sex at a bar.

“I mean the, the most stupid thing you can do, which is what every mutual fund firm in the world always did, was to brag about performance, uh, in, in a direct mail piece, which is a little bit like walking into a bar if you’re a single guy and you want to get laid and walking up to some girl and saying, ‘Hey, you want to have sex?'” Fisher said, according to audio obtained by CNBC.

When asked for comment, a spokesman for Fisher Investments referred back to the money manager’s apology.

“Some of the words and phrases I used during a recent conference to make certain points were clearly wrong and I shouldn’t have made them,” Fisher said in a statement. “I realize this kind of language has no place in our company or industry. I sincerely apologize.”

Organizers of both conferences subsequently banned him from speaking again in the future.

Be the first to comment